-

Using Crunchbase for Competitor Analysis

Gaining a competitive advantage is not possible without first analyzing your competitors. As you glean big data, it can become a resource by which a company refines their business strategy.. All of the smartest moves, sharpest pivots and most market-responsive acts are steeped in competitor analysis. The benefits are obvious; the process is not always easy.

The internet has, in…Read More

Gaining a competitive advantage is not possible without first analyzing your competitors. As you glean big data, it can become a resource by which a company refines their business strategy.. All of the smartest moves, sharpest pivots and most market-responsive acts are steeped in competitor analysis. The benefits are obvious; the process is not always easy.

The internet has, in…Read More -

Types of Market Research: Qualitative vs. Quantitative

Qualitative techniques tend to be used early in the research process. They enable researchers to identify common ideas, needs, and concepts that merit further exploration.

Quantitative techniques are used to prove or disprove the hypotheses generated by qualitative techniques. Quantitative research adopts various primary research techniques to produce vast quantities of data.

The two approaches complement each other well, and…Read More

Qualitative techniques tend to be used early in the research process. They enable researchers to identify common ideas, needs, and concepts that merit further exploration.

Quantitative techniques are used to prove or disprove the hypotheses generated by qualitative techniques. Quantitative research adopts various primary research techniques to produce vast quantities of data.

The two approaches complement each other well, and…Read More -

Using Michael Porter’s Competitive Strategies In Your Business

Porter’s competitive strategies offer organizations of all shapes and sizes a valuable roadmap towards success. By basing the core elements of their competitive strategy on one of Porter’s approaches, organizations can take their first steps toward building a sustainable competitive advantage. Over time, these competitive advantages help organizations to outperform their competitors, translating to continued growth and superior financial returns.…Read More

Porter’s competitive strategies offer organizations of all shapes and sizes a valuable roadmap towards success. By basing the core elements of their competitive strategy on one of Porter’s approaches, organizations can take their first steps toward building a sustainable competitive advantage. Over time, these competitive advantages help organizations to outperform their competitors, translating to continued growth and superior financial returns.…Read More -

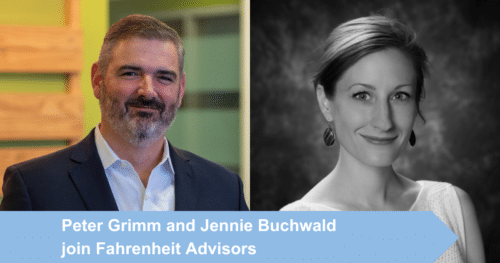

New Expertise Helps Fahrenheit Clients With Business Disruption Preparedness

No business or industry is insulated from disruption caused by technology advancements, workforce transitions, talent shortages, and other fast-moving trends. With the right planning, however, business leaders can anticipate disruption, avoid surprises, and seize opportunities.

Fahrenheit recently welcomed Peter Grimm and Jennifer Buchwald to help clients capitalize on change with:

Sophisticated strategic planning anchored by comprehensive market and competitive intelligence…Read More

No business or industry is insulated from disruption caused by technology advancements, workforce transitions, talent shortages, and other fast-moving trends. With the right planning, however, business leaders can anticipate disruption, avoid surprises, and seize opportunities.

Fahrenheit recently welcomed Peter Grimm and Jennifer Buchwald to help clients capitalize on change with:

Sophisticated strategic planning anchored by comprehensive market and competitive intelligence…Read More -

How a Fractional Sales Leader Drives Quicker Results

When results and leadership are needed sooner rather than later, an experienced fractional sales professional can catalyze your company to achieve its sales goals more quickly, efficiently, and ensure a greater return on investment before investing in a full-time sales leader.

How do you know if you need a fractional sales leader?

1.) Can the current sales team build…Read More

When results and leadership are needed sooner rather than later, an experienced fractional sales professional can catalyze your company to achieve its sales goals more quickly, efficiently, and ensure a greater return on investment before investing in a full-time sales leader.

How do you know if you need a fractional sales leader?

1.) Can the current sales team build…Read More -

Turn Your Competitive Research into an Action Plan

Understanding and then reacting to a changing competitive landscape is required of any business, but not everyone gets it right. It is understandable that many leadership teams prioritize the efficiency of operations, streamlining of communication, and even product development above looking up and out into the market. The outcome of doing this is most-often a best-of-breed-product/service that is no longer…Read More

Understanding and then reacting to a changing competitive landscape is required of any business, but not everyone gets it right. It is understandable that many leadership teams prioritize the efficiency of operations, streamlining of communication, and even product development above looking up and out into the market. The outcome of doing this is most-often a best-of-breed-product/service that is no longer…Read More -

Consulting Team from Cipher Joins Fahrenheit Advisors

Peter Grimm and Jennie Buchwald strengthen Fahrenheit’s management consulting and strategic advisory Team with specialized competitive intelligence skills

Fahrenheit Advisors announced today that Peter Grimm, president of Cipher, and Jennifer Buchwald, manager at Cipher, have joined Fahrenheit’s Business Advisory practice. The addition will enhance the firm’s management consulting services for middle-market companies with strategy expertise, disruption planning, disruption preparedness, as…Read More

Peter Grimm and Jennie Buchwald strengthen Fahrenheit’s management consulting and strategic advisory Team with specialized competitive intelligence skills

Fahrenheit Advisors announced today that Peter Grimm, president of Cipher, and Jennifer Buchwald, manager at Cipher, have joined Fahrenheit’s Business Advisory practice. The addition will enhance the firm’s management consulting services for middle-market companies with strategy expertise, disruption planning, disruption preparedness, as…Read More -

The 7 Greatest Challenges in Market and Competitive Intelligence

Market and competitive intelligence (M/CI) is an essential component of successful organizations. But it’s a very complex field. There’s a network of stakeholders to manage, an unfathomable amount of data, and sometimes, a lack of clarity across the organization. Knowing how to recognize and react to these common challenges is a critical skill for competitive intelligence professionals.

M/CI is absolutely worth…Read More

Market and competitive intelligence (M/CI) is an essential component of successful organizations. But it’s a very complex field. There’s a network of stakeholders to manage, an unfathomable amount of data, and sometimes, a lack of clarity across the organization. Knowing how to recognize and react to these common challenges is a critical skill for competitive intelligence professionals.

M/CI is absolutely worth…Read More -

How Geography Affects Employee Compensation Philosophy

While 2022 brought back some sense of normalcy to the working world, the pandemic's aftermath still wreaks havoc in the world of compensation. Even companies accustomed to dealing with varying cost-of-labor rates based on multiple office locations face new challenges with remote and flexible work schedules.

The bottom line is this: if employees are working in multiple geographic locations —…Read More

While 2022 brought back some sense of normalcy to the working world, the pandemic's aftermath still wreaks havoc in the world of compensation. Even companies accustomed to dealing with varying cost-of-labor rates based on multiple office locations face new challenges with remote and flexible work schedules.

The bottom line is this: if employees are working in multiple geographic locations —…Read More -

Business Process Automation: Start Small for Big Benefits

Automation is not as scary or complex for small and mid-sized businesses as you think. Start small and AIM AT Results.

When CEOs of small and mid-sized businesses see economic uncertainty on the horizon, they often need help determining where and when to rein in costs. The decisions are tricker for these companies because they lack the operational redundancies that…Read More

Automation is not as scary or complex for small and mid-sized businesses as you think. Start small and AIM AT Results.

When CEOs of small and mid-sized businesses see economic uncertainty on the horizon, they often need help determining where and when to rein in costs. The decisions are tricker for these companies because they lack the operational redundancies that…Read More