Important Compensation Considerations for Your Company’s Budgeting Process

As you head into your company’s budgeting season, it is crucial to stay up to date on the latest trends in compensation in order to attract and retain top talent. 2025 will bring significant changes that can impact your organization’s compensation strategies. In this article, we will share three critical considerations to inform your budgeting process for the upcoming year:

- Address FLSA changes going into effect on January 1, 2025

- Ensure base pay aligns with your company’s philosophy and market rates

- Consider a total rewards package with benefits that are truly inclusive for all employees

3 CRITICAL CONSIDERATIONS TO INFORM YOUR BUDGETING

1.) address flsa changes

The Department of Labor (DOL) introduced the new Fair Labor Standards Act (FLSA) regulations that go into effect as of January 1, 2025, (assuming current legal challenges do not prevail) that could significantly impact your workforce.

Jobs with:

- Salary ranges starting under the Federal $58,656 threshold, and/or

- Exempt employees making less than this amount, and

- Jobs that no longer meet the Federal highly compensated threshold of $151,164 need to be reviewed

Virginia follows the Federal guidelines, but some states have different thresholds. If you have employees in other states, check those state guidelines to ensure you are compliant in each state. These changes necessitate a careful review of your current compensation and job classification practices.

updating job descriptions

Take this opportunity to update job descriptions and ensure they accurately reflect the level of responsibility and requirements for each position. This will help in determining whether a position should be classified as exempt or re-classified as non-exempt, particularly as it pertains to highly compensated employees. Accurate job descriptions also provide clarity to employees about their roles and expectations, reducing the potential for misunderstandings regarding job responsibilities.

reviewing jobs for exemption

Once job descriptions have been reviewed, organizations can re-evaluate which jobs qualify as exempt from overtime, and which do not. First, companies need to look at salary ranges for each job, and then at current salaries for employees in these jobs. For jobs with salary ranges below the thresholds, companies must decide whether to increase the ranges to maintain exempt status or reclassify them as non-exempt, making them eligible for overtime pay.

Next companies need to look at actual employee salaries to ensure they meet the threshold. It’s possible that exempt employee salaries are above the threshold but that the minimum of the salary range assigned to the job is below the threshold. Note that classification changes should apply to all employees within a job. If a job is re-classified as non-exempt, all employees in the same job should be re-classified, regardless of their individual salary levels. It’s possible that a long-tenured employee could be above the threshold but a newer employee is below the threshold for a particular job. Both should be reclassified.

budget and employee impact

The reclassification of jobs from exempt to non-exempt can have significant budgetary implications. The new salary threshold of $58,656 is a 40.7% increase from January 2024. The new HCE threshold of $151,164 is an even more significant jump – 64.9%. Organizations must account for potential overtime costs and adjust their budgets accordingly. Additionally, this change could affect employee morale, especially if employees perceive a shift from exempt to non-exempt status as a demotion. Clear communication and a well-thought-out strategy are essential to manage these transitions smoothly. Start by assessing the salary ranges for the affected jobs, and then look at each employee. Options for next steps include:

- Standard Minimum Threshold: $58,656 per year ($1,128/week)

- Adjust salary to new minimum and maintain exemption

- Reclassify as non-exempt, and:

- Maintain pay level/hours worked, paying overtime as needed

- Reduce salary and pay overtime (to approximately equal current pay)

- Cap hours at 40 per week; shift workload or hire additional staff as needed

- Highly Compensated Employees (HCE): $151,164 per year (at least $1,128/week)

- Adjust salary to new minimum and maintain exemption

- Adjust job duties to qualify against standard duties exemption requirements

- Cost-benefit analysis – cost of higher salary v. overtime pay

- Communicate:

- Explain that the adjustments are DOL/FLSA-driven changes

- Make sure employees moving from exempt to non-exempt fully understand time keeping requirements

- Address any internal equity issues, e.g., off cycle raises for certain employees, grade shifts for certain jobs, etc.

2.) market data: benchmarking and salary integrity

Addressing the new FLSA rules will most likely necessitate changes that need to be made throughout your organization. Whether you move jobs from one grade to another, increase salaries to maintain exemption, or reclassify jobs, these changes will change the current balance. As we move into 2025 budget season, it’s time to refresh market data and reassess salary structures to ensure jobs are properly aligned.

benchmarking jobs

Benchmarking involves comparing your organization’s job roles and salaries against industry standards and market data. This process helps you ensure that your compensation is competitive, which is essential for retaining top talent and preventing turnover. Regular benchmarking is key to keeping your salary ranges in line with market trends.

data integrity

Accurate and up-to-date data is the foundation of effective benchmarking. Invest in reliable compensation data sources to ensure that your salary data reflects the most current market conditions. Ideally companies will pull from multiple sources to ensure the data are not skewed and biases are not formed. Working with a third-party consultant, especially for smaller companies and non-profits without the resources of a compensation department or multiple survey sources, is a great way to maintain fresh data and eliminate bias from the process. Most importantly, do not rely on internet searches, Artificial Intelligence, or other “free” data sources. Data integrity is critical to ensuring you have valid numbers to support your compensation decisions.

update salary ranges

Based on your benchmarking efforts, updating your salary ranges may be necessary to remain competitive. Adjusting salary ranges helps prevent salary compression and ensures long-tenured high performers have room in their salary ranges for growth. Benchmarking also ensures that your pay scales are aligned with the market and that you are offering competitive compensation packages that attract and retain high-quality employees.

3.) benefits package: how to include all employees

With so many states requiring that salary ranges be posted with job openings, companies have an opportunity to use this to their advantage. Have you been ramping up your benefits offerings with the newest fads, only to realize that most of your employees are not using the benefits? If a cost-benefit analysis of benefits and perquisites determines that a company is not meeting the needs of some or all of their employees, consider eliminating the ancillary benefits and adding the cost savings to salaries.

In 2025, the focus on inclusivity in benefits packages will continue to grow. As the workforce becomes more diverse, the thought is that benefits offerings must be inclusive and accessible to all employees, regardless of their life stage or circumstances. But is this possible? Do all of your employees have the exact same needs? Are you spending a significant amount of time and resources trying to implement an assortment of benefits?

re-evaluating benefits

Take the time to re-evaluate your current benefits package to ensure it meets the needs of a diverse workforce. Consider whether every employee can utilize each benefit you offer. For example, benefits like childcare might not be relevant for all employees, while options like generous PTO policies and company contributions to retirement plans have broader appeal. What about eliminating ancillary benefits and increasing base salaries?

If salaries are targeted at the 75th percentile, for example, potential employees looking at the salary ranges in job postings will be impressed by the higher-than-normal salary range and/or an attractive incentive plan that rewards excellence.

benefits for all employees

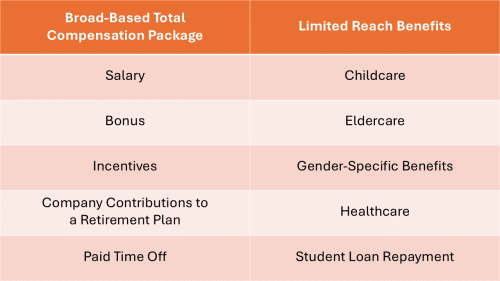

An inclusive benefits package is one that offers value to all employees. Unless all employees have the exact same needs, it is impossible to create a benefits package that is beneficial to everyone. Let’s look at the difference:

the impact of a broad-based total compensation package

A broad-based total compensation package not only helps in attracting and retaining a diverse workforce, it also contributes to overall employee satisfaction and engagement. Employees are given the flexibility and freedom to earn more and spend more on the things that are important to them. It also ensures that the company is not “paying” certain employees significantly more for the same job, just because one employee has a need for certain benefits and another employee does not.

Review your compensation philosophy and take inventory of your employees to ensure that your compensation strategy fits your corporate culture. Conduct a cost-benefit analysis – will you save on administration and compliance costs? Will this off-set any tax advantages you might receive currently from certain benefits? Don’t be afraid to think out of the box and create a balanced total compensation package that works for all employees.

Conclusion

As 2025 approaches, it’s imperative to prepare for the changes and challenges ahead. By focusing on the upcoming FLSA changes, ensuring your base pay aligns with market rates, and considering a new approach to benefits, companies can navigate the complexities of the new year with confidence. Staying proactive in these areas will help you attract and retain top talent, ensuring you remain competitive in an ever-changing employment landscape.

“As we move into budget season, it is time to refresh market data and reassess salary structures to ensure jobs are properly aligned.”

Working with a third-party consulting firm, like Fahrenheit Advisors, is the best way to obtain fresh market data and eliminates bias from the process. ENSURE YOUR COMPANY’S COMPLIANCE AND TALENT ATTRACTION AND RETENTION WITH A SOLID COMPENSATION STRATEGY. Reach out to get started today.

About the author

Merryman Putnam partners with clients to provide compensation expertise in crafting total compensation packages designed to ensure companies are able to hire the right talent. For 20+ years she has worked with public, private, private equity, government, tribal, and nonprofit entities in a variety of industries including aerospace/engineering, banking/finance, healthcare (including FQHCs), insurance/workers’ compensation, manufacturing, technology/software asset management, transportation and utilities.

Merryman Putnam partners with clients to provide compensation expertise in crafting total compensation packages designed to ensure companies are able to hire the right talent. For 20+ years she has worked with public, private, private equity, government, tribal, and nonprofit entities in a variety of industries including aerospace/engineering, banking/finance, healthcare (including FQHCs), insurance/workers’ compensation, manufacturing, technology/software asset management, transportation and utilities.