Ensure Timely and Accurate Financials With a WIP Report

The Work in Progress report is an important tool, used primarily by construction, engineering, supply chain management, and other companies involved in complicated multi-step projects which involve timelines stretching over months, and in some cases, years. This article, written with the construction industry in mind, briefly surveys the usefulness of the WIP report and the inherent hazards of improper usage.

What is a WIP Report?

A WIP report provides business decision makers the financial metrics needed to manage long-term projects efficiently and profitably.

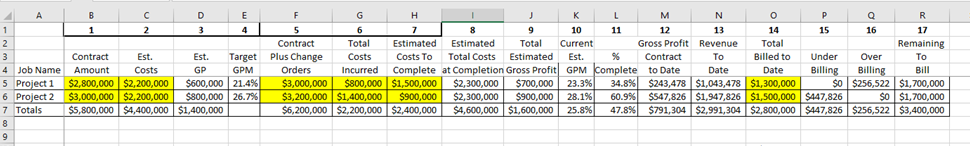

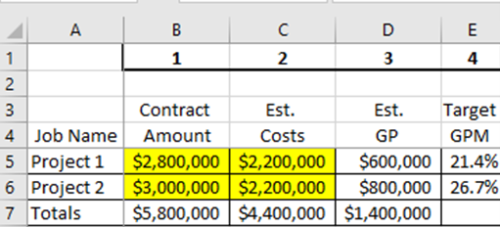

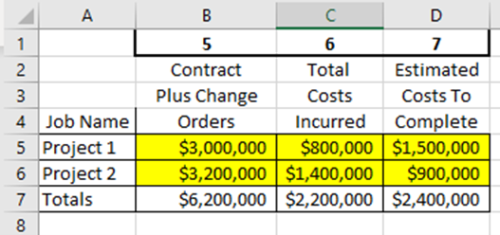

By project, the WIP spreadsheet presents many “packets” of related information. Information on most WIPs is arrayed, from left to right, as follows (assume projects are executed within one fiscal year; yellow highlighted cells are input cells, non-highlighted cells contain calculations):

what do the columns represent?

Columns 1 – 4

present the projects as detailed in the signed contract

Columns 5 – 7

include change orders as work on projects progresses

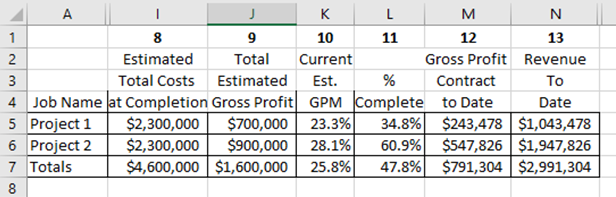

Columns 8 – 13

Columns 8 – 13

present current cost estimates as work progresses – current Gross Profit & recognized revenues

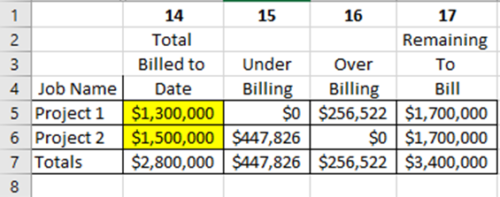

Columns 14 – 17

detail billings to date, over/under billings (described below) & expected revenues yet to be billed

OVER BILLING & UNDER BILLING EXAMPLES

For illustrative purposes, our Project 1 is portrayed as “over billed” (i.e., billings to customer exceed recognized revenue to date; such over billings are presented as a liability on the company balance sheet). Conversely, our Project 2 is portrayed as “under billed” (i.e., billings to customer are less than recognized revenue to date; such under billings are presented as an asset on the company balance sheet).

GROSS PROFIT MARGIN

Let’s take a moment and carefully review the nature and importance of each of the inputs into the WIP schedule. Columns 1 – 4 present the historical benchmark of the company’s negotiated terms. Maintaining this benchmark data allows the company to continually reassess the fitness and accuracy of its bidding, pricing, and negotiating success, or failure, principally keying off the Gross Profit Margin (GPM) at contract signing, compared to current GPM and then final GPM upon project completion.

CHANGE ORDERS

Column 5 presents the contract with any “Change Orders” (CO) added in. It is of crucial importance that the company maintain strict diligence in assigning COs to customer-requested additional work, above and beyond the scope of the original contract. Often, in the rush to complete projects, the customer will demand work without formal, signed COs and the recordation of this type of work can, at times, “fall between the cracks.” Needless to say, any and all work beyond the scope of the original contract must be documented and appropriate compensation must be defined and collected, otherwise reported numbers will be skewed.

TOTAL COSTS INCURRED

Column 6: “Total Costs Incurred” – our assumption is that all costs are recorded and properly assigned by field operators and are then appropriately classed by the company accounting system (an assumption which should be periodically tested and verified).

ESTIMATED COSTS TO COMPLETE

Column 7: “Estimated Costs to Complete” is the single most important driver of the WIP. It is absolutely essential to strive to be as accurate and realistic as possible in forecasting this number – this one number drives much of the output calcs of the WIP. Bottom line: a great deal of mischief can be created by unintentional and or intentional mis-forecasting of this most critical input (more about the “mischief” below).

CONTRACT STATUS

Columns 8 – 13 are all calculated numbers which present the current status of the contract – GPM, Revenue to Date, etc. The “% Complete” figure (column 11) is calculated by dividing “Total Costs Incurred” (column 6) by “Estimated Total Costs at Completion” (column 8). As previously stated, “Estimated Costs to Complete” (column 7) bear in here significantly and this “% Complete” figure is dependent upon an accurate good-faith estimate of costs to be incurred. Another potential hazard of this “% Complete” figure is that many companies look to this number as a proxy for a budget – namely they do not either have a formal budgeting process in place, or primarily rely upon this “% Complete” figure to inform them about the completion status of a project. Using the “% Complete” figure as a proxy for a formal, parallel track budgeting process is fraught with difficulties. If a company is involved in fairly straight-forward, shorter term projects and is able to consistently formulate reliable future estimated costs, such a practice can provide a usable estimate. But, as a company engages in more complex, longer-term projects, and experiences ongoing difficulties in accurate future cost estimating, looking at the “% Complete” figure as a proxy for a budgeting metric can be very misleading and result in operating and financial reporting which is not supportive of timely management decision making.

Column 14 – “Total Billed to Date” is an input number from accounting records (Note: this is not a cash number, in that it does not represent cash collected, but merely amounts billed) – prompt billing is key to cash flow and much effort must be exerted to ensure that billing is timely and any exceptions (namely invoices contested by customers) are addressed and vigorously pursued to resolution.

UNDERBILLING

Columns 15 and 16 compare columns 13 and 14, seeking to determine billing status, namely “Under Billing” (i.e., the company has executed work for which it has not yet billed the customer, hence this amount appears as an asset on the company’s balance sheet) or “Over Billing” (namely the company has billed the customer for work which it has yet to complete, hence this amount appears as a liability on the company’s balance sheet).

Underbillings potentially signal a host of problems with the company’s field operations and accounting department; another concern is that bonding agents look at the underbilled amount on a balance sheet and often discount this amount, the concern being the potential uncollectability of such amounts.

Overbillings while providing cash flow for working capital and strengthening the balance sheet, can also pose risks. The temptation of using cash for other projects, mismatching of cash flows and dividending out cash can result in cash shortfalls, especially when a project experiences cost overruns and the “pre-collected” cash has been utilized for other projects or removed from the company.

Common practice includes netting the over and under billed amounts and including the net amount along with the total revenue billings on the Profit and Loss Statement – only strict, accurate forecasting will allow for this net number to be truly informative. The greater the laxity in cost estimating, the more distorting and misleading these numbers can become over time, severely impairing management’s ability to rely upon financial reporting in support of executive decision making.

REMAINING TO BILL

Lastly column 17 – “Remaining To Bill” – a simple calc from previous inputs and used in both cash flow forecasts and backlog reports.

General Considerations

Construction firms are often founded by working on shorter term, relatively non-complicated projects. In the life cycle of a construction firm, most firms begin with an unlevered balance sheet. The significance of an unlevered balance sheet is that the P&L can serve as a proxy for a cash flow report in that there are few, if any, adjustments which need to be made to the balance sheet and P&L, in terms of depreciation, interest, amortization, etc. This allows a reviewer to gain a fairly accurate sense of payment flows from reviewing a P&L, a job cost report and a WIP. However, as projects become more complicated, longer term (more than one year; one fiscal reporting period), perhaps more geographically dispersed, and especially when debt is used for equipment and other assets, the ability of management to gain useful ongoing insights from financial reporting is greatly diminished if a formal budgeting process is not implemented and a rigorous process of estimating costs is absent.

It is an ongoing challenge, especially in the very complicated environment which many construction firms operate, to establish and maintain a reliable and accurate reporting framework.

7 Essential Elements in a Timely & Accurate Monthly Reporting Cycle:

- Accurate and timely reporting of costs from field operations to accounting

- Timely customer billings and collections

- Accurate monthly remaining “costs to complete” estimates and monthly review of previous months’ “cost to complete” estimates

- Monthly budgeting by project

- WIP reporting

- Job Cost Reporting (i.e., report which presents the various cost elements of a project)

- A formal budgeting process

The one element which is often lacking in the above list is a formal budgeting process. Why is that? Founders and early-stage company managers often feel that, armed with a Job Cost Report and a WIP, they can manage their company without a formal budgeting process. Again, this approach is workable if a company pursues relatively short duration projects that are uncomplicated, and as stated above, does so with an unlevered balance sheet. But as operations grow, become more complicated, involve longer duration projects, and as debt is added to the balance sheet, more tools are required to enable managers to gain an accurate sense of payment flows and project status. The bottom line is that successful firms strive to harmonize the various elements of a robust reporting framework (as detailed in the seven elements directly above) in order to secure timely and accurate insights into the company’s results. Without such insights, effectively managing a firm is greatly impaired and underperformance is almost certain.

Fahrenheit Advisors has a number of highly seasoned consultants who have worked closely with managers of construction firms with the aim of providing best-in-class management tools and techniques to specifically address the unique needs of the construction industry.

From managing rapid growth and expansion, to attracting and retaining high-performance employees, to creating cash flow forecasting and cost reduction strategies, our experienced industry-specific consultants are the game-changers you need to tackle your unique challenges, make informed business decisions and maximize your results.

We would welcome the opportunity to meet with you and discuss your unique needs and how we might assist you in setting the straightest path to profitable growth.