(UPDATED) COVID-19: Navigating the SBA Disaster Assistance Program

EIDL PROGRAM UPDATE

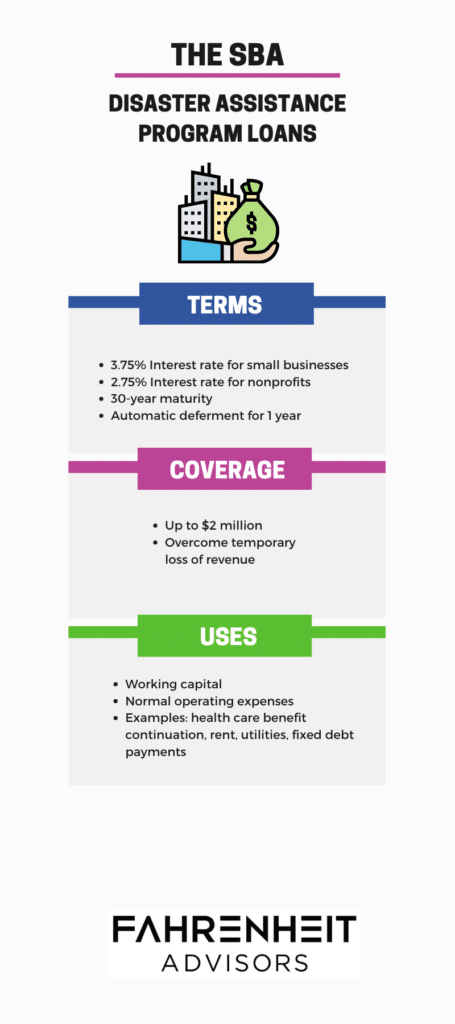

The SBA has provided $20 billion to small businesses and nonprofits through the Economic Injury Disaster Loan Advance (EIDL) Program. Fahrenheit business transformation expert, Tim Hayes has provided helpful resource links to access small business loans. Funds are still available with very affordable terms:

- 3.75% interest rate for small businesses

- 2.75% interest rate for nonprofits

- 30-year maturity

- Automatic deferment of 1 year before monthly payments begin

PROGRAM OVERVIEW

The U.S. Small Business Association (SBA) provides Disaster Assistance up to $2,000,000 for businesses and nonprofits.

As part of the Nation’s response to COVID-19, the SBA has implemented a direct loan program providing up to $2 million in assistance to help overcome the temporary loss of revenue by businesses and nonprofits. The loans may be used to pay fixed debts, payroll, accounts payable, and other bills; loan repayment terms can be up to 30 years with low-interest rates.

- To see if your state or territory is eligible, please visit: sba.gov/funding-programs/disaster-assistance.

- SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance to provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

- These loans may be used to pay fixed debts, payroll, accounts payable, and other bills because of the disaster’s impact. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%.

- SBA offers loans with long-term repayments, thereby keeping payments affordable, up to a maximum of 30 years. Loan terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

- For questions, please contact the SBA disaster assistance customer service center at 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov.

- If your company has good historical credit, then this program may not be the best option.

Due to the rapidly changing regulations and program specifics, some items in this post may have changed since the publication date.

About the Author

Tim Hayes works with company executives to provide strategic, financial, and entrepreneurial counsel across a variety of industries including manufacturing, business to business services, technology, government agencies, financial institutions and nonprofits. Tim is skilled in creating platforms for change implementation to enhance performance or turnaround under-performing organizations. His expertise includes developing strategies for revenue enhancement, cost containment, balance sheet maximization, public-private teaming platforms, and risk mitigation.