-

The Seven Deadly Sins of Entrepreneurs (And How to Fix Them)

The Seven Deadly Sins of Entrepreneurs (And How to Fix Them) By Peter S Buchanan, Managing Partner Fahrenheit Advisors It’s an age-old and true maxim that great entrepreneurs usually don’t make it to the executive suite at IBM, GE, HP, or Exxon. Big companies love the upside – the passion, the long hours, the breakthrough thinking, the ability to inspire…Read More -

Startup Weekend Fredericksburg Had It Covered

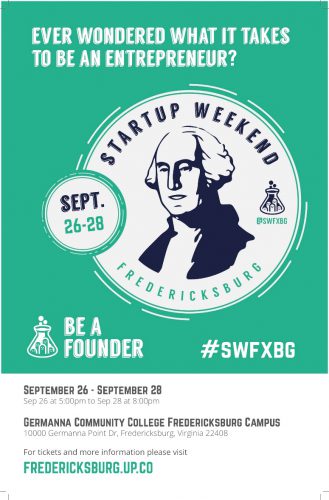

From Trade Shows to Christmas Lights to Earthworms: Startup Weekend Fredericksburg Had It Covered

Recently, Germanna Community College hosted Fredericksburg’s third Startup Weekend in 18 months. In 54 hours, eight teams came together and developed, researched and launched companies that brought in sales before the judging on Sunday evening. Scott Ukrop represented Fahrenheit as a judge along with DJ Bruggemann,…Read More

From Trade Shows to Christmas Lights to Earthworms: Startup Weekend Fredericksburg Had It Covered

Recently, Germanna Community College hosted Fredericksburg’s third Startup Weekend in 18 months. In 54 hours, eight teams came together and developed, researched and launched companies that brought in sales before the judging on Sunday evening. Scott Ukrop represented Fahrenheit as a judge along with DJ Bruggemann,…Read More -

Have You Noticed the Shift in How Work is Getting Done?

There has been a significant shift in how work gets done. For many organizations the changing market landscapes and uncertain economies have outpaced the skill of internal leadership. Companies find themselves in need of deeper and more specialized skill sets to overcome the challenges of the day. The rise of interim and fractional leaders is here and this tide does…Read More

There has been a significant shift in how work gets done. For many organizations the changing market landscapes and uncertain economies have outpaced the skill of internal leadership. Companies find themselves in need of deeper and more specialized skill sets to overcome the challenges of the day. The rise of interim and fractional leaders is here and this tide does…Read More -

Trademark Due Diligence — A Mark of the Future

When companies merge in the 21st Century, it is often to add value through intellectual capital rather than adding additional office space or factories. This is due to the fact that, increasingly, intellectual assets can be worth more than fixed assets when it comes to a company's value. Consequently, it is no surprise that valuing intellectual property has become an increasingly…Read More

When companies merge in the 21st Century, it is often to add value through intellectual capital rather than adding additional office space or factories. This is due to the fact that, increasingly, intellectual assets can be worth more than fixed assets when it comes to a company's value. Consequently, it is no surprise that valuing intellectual property has become an increasingly…Read More -

Entrepreneurs: How many truly need venture capital?

We’ve had the pleasure of getting to know Ted Zoller, Director of the Center for Entrepreneurial Studies and Associate Professor of Strategy and Entrepreneurship at UNC Chapel Hill. Ted is a 1987 William and Mary grad, and has been kind to include us in the UNC Soft Launch Program.

In a recent interview with the Triangle Business Journal, Ted talks…Read More

We’ve had the pleasure of getting to know Ted Zoller, Director of the Center for Entrepreneurial Studies and Associate Professor of Strategy and Entrepreneurship at UNC Chapel Hill. Ted is a 1987 William and Mary grad, and has been kind to include us in the UNC Soft Launch Program.

In a recent interview with the Triangle Business Journal, Ted talks…Read More -

Intellectual Property in M&A: Patenting a System for Success

In the global, new media economy, intellectual property due diligence has taken on increased importance in M&A negotiations. And one of the most important categories of intellectual property due diligence is patents. Even companies without significant patent portfolios are bringing in due diligence teams to identify patentable assets and add value. Read the full article here for a closer look…Read More

In the global, new media economy, intellectual property due diligence has taken on increased importance in M&A negotiations. And one of the most important categories of intellectual property due diligence is patents. Even companies without significant patent portfolios are bringing in due diligence teams to identify patentable assets and add value. Read the full article here for a closer look…Read More -

Court Gives ESOP Sponsor Latitude When Stock Value Tanked

Employee Stock Ownership Plans (ESOPs) were created as a way for employers to turn employees into mini-partners in the business. Some small business owners look to ESOPs to be financing mechanisms that facilitate succession planning, with the idea of eventually selling the business to the ESOP trust (thanks to tax incentives). But what happens when the value of the company's…Read More -

Dave Bosher Appointed as interim CFO at AmpliPhi Biosciences Corporation

On June 30, 2014, AmpliPhi Biosciences Corporation appointed Dave Bosher, Managing Director of Fahrenheit Advisors, to serve as the Company's interim Chief Financial Officer. We are excited to have the opportunity to support the needs at AmpliPhi Biosciences.

AMPLIPHI BIOSCIENCES CORP FILES (8-K) Disclosing Change in Directors or Principal Officers, Submission of Matters to a Vote of Security HoldersRead More

On June 30, 2014, AmpliPhi Biosciences Corporation appointed Dave Bosher, Managing Director of Fahrenheit Advisors, to serve as the Company's interim Chief Financial Officer. We are excited to have the opportunity to support the needs at AmpliPhi Biosciences.

AMPLIPHI BIOSCIENCES CORP FILES (8-K) Disclosing Change in Directors or Principal Officers, Submission of Matters to a Vote of Security HoldersRead More -

Are You Owed Money from a Business that Filed for Bankruptcy?

Suppose you've been doing business with a company that owes you money or has been late in paying for services you have provided. You might have even filed a lawsuit to obtain the payments. But then you receive a notice that the company has filed for bankruptcy. If a business that owes your company money files for bankruptcy, it's important…Read More -

Combinations for Growth

If your company has decided the best way to grow is to expand your ownership boundaries, you are probably considering either a merger or an acquisition. Mergers and acquisitions offer opportunities for growth that can provide many benefits to your existing business. But they also present many chances for taking a wrong turn. Keep reading for a rundown on the…Read More

If your company has decided the best way to grow is to expand your ownership boundaries, you are probably considering either a merger or an acquisition. Mergers and acquisitions offer opportunities for growth that can provide many benefits to your existing business. But they also present many chances for taking a wrong turn. Keep reading for a rundown on the…Read More -

Taking the Acquisition Route

Buying the assets or stock of another corporation is one way to quickly expand your business. But there are several issues to consider before making a final decision. With taxable direct purchases, the buyer simply pays cash or issues debt (or a combination) in exchange for the target corporation's stock or assets. This compares to a merger where the buyer…Read More

Buying the assets or stock of another corporation is one way to quickly expand your business. But there are several issues to consider before making a final decision. With taxable direct purchases, the buyer simply pays cash or issues debt (or a combination) in exchange for the target corporation's stock or assets. This compares to a merger where the buyer…Read More -

Lou Marmo, Fahrenheit Advisors Managing Director to speak at The Capital Roundtable’s ENCORE

Private Equity Investing In Niche Manufacturing Companies As the “Made-in-America” Trend Picks Up Speed, Operations Holds the Key to New Opportunities Join conference chairman Matthew P. Guenther, partner at GenNx360 Capital Partners LP, for this program featuring shared insights from top PE professionals. You'll hear real-world perspectives, lessons learned, and industry outlooks, plus insights on managing current portfolio companies. Joining…Read More