M&A Deal is Done, Now What? Time to Integrate the Sales Force

So, you’ve closed on an M&A deal and you’re going to make this new asset part of your existing organization. Diligence revealed that this addition to your business will support your strategic goals and the integrated company will produce value beyond the acquisition cost. Now what?

So, you’ve closed on an M&A deal and you’re going to make this new asset part of your existing organization. Diligence revealed that this addition to your business will support your strategic goals and the integrated company will produce value beyond the acquisition cost. Now what?

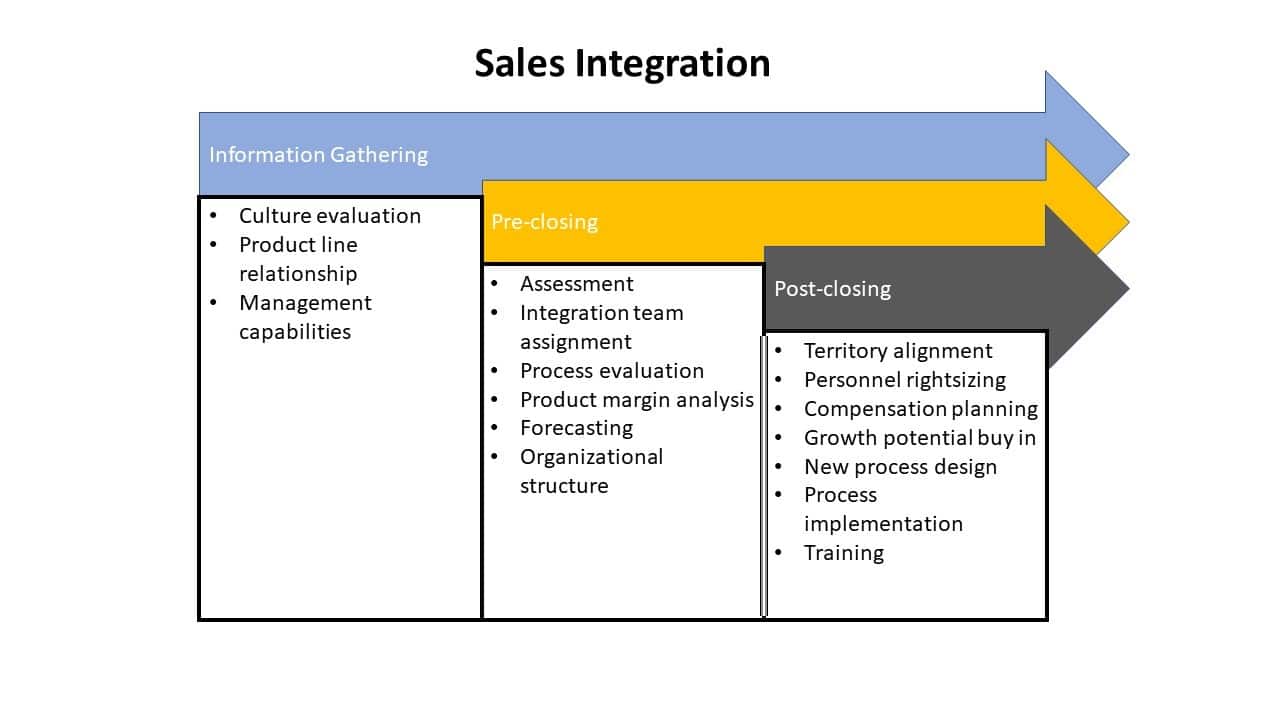

Presumably you’ve read the abundance of literature reporting M&A failure rates between 70% and 90%. An equal number of articles will advise on key initiatives to avoid this fate. If you have been disciplined in your search and honest in your valuation, you have a better shot than most at realizing the predicted gains but that will ultimately rest on a good integration plan and great execution.

Your Integration Team

Your integration plan should start with a solid team to address culture differences, consolidate operations, and manage the human capital all while trying to maintain momentum in your core business. Each area of your business is unique and during this time they will each have special requirements. Key leaders assigned to the integration team will be invaluable during this period. However, integration of two sales forces can pose particularly challenging issues and disruption here can have a very direct and measurable impact on expected growth.

Your Sales Team Will Wonder: “How Does This Transition Affect Me?”

Sales forces are made up of inside sales teams, outside sales, or a combination of both. Although inside sales will have similar exposure to your in-house integration programs and training sessions, outside sales personnel often work from home in remote locations and do not have daily contact with colleagues with whom they can confide in or seek guidance. That remote work component can compound your troubles, but that should not be new for you. Regardless of their role, sales people often embody specific personality traits that make it imperative to act decisively and communicate clearly. Large portions of their income and performance evaluations are tied to their revenue generation.

These are competitive people. If they perceive that unrelated integration initiatives will affect their ability to reach their goals and therefore their target income you may experience some stress, resistance or in the worst-case unwanted attrition. Considering this integration in your pre-sale diligence period will help you navigate these waters and properly assess the long-term implications.

No Matter the Type of Deal — Scope or Scale — Address Questions Quickly

All personnel from both companies will have questions regarding employment. Who stays, who goes, and what is the criteria? It will be good policy to address this quickly for everyone to minimize stress and attrition.

For sales forces, the equation is quite complex, but it also presents opportunities for improvement. If the acquisition is a scope deal, you will need to consider the structure of your current sales force and if they can achieve your projections on top of what they are already doing.

If there are more SKUs to sell, is territory realignment necessary to keep the right focus on the right products? And what are those right products? Other questions:

- Will the addition of new products reduce or boost total margin contribution?

- Are your incentive plans creating the sales activities that will accomplish your business objectives?

Any new product or skills training required by either sales force should be swift and thorough, and any realignment should be supported with evidence of how it will create benefit for the reps (higher earning potential, better working environment, etc).

If it is a scale deal, you will likely see significant overlap in product offerings and skill sets between the sales forces. Your personnel decisions will be based more on work load, coverage, and market penetration. This presents an opportunity for top grading and ending up with the highest quality sales force you can create with the assets already on board. Swift action will again be helpful to avoid losing talent to instability and uncertainty.

In both scale and scope deals, management and reporting considerations are imperative. There will be fewer managers to contend with from either company and properly trained and supported managers are more likely to be able to take on greater responsibilities. However, management styles and processes should be understood well before the integration begins.

Product sales cycles can vary considerably and management reporting demands and cadence will vary. Forcing less effective legacy management techniques onto a new management team my have a net negative result. On the other hand, a new management team may bring a new perspective on successful management processes and provide opportunities for improvement.

No matter the situation, culture comparisons must be matched with evidence-based techniques, and the right fit should be found for this new organization. Remember, you are not trying to create A+B = AB. You want A+B = C.

If you are considering an M&A deal, Fahrenheit has the skills and experience to assist you from beginning to end. Strategy experts and seasoned sales executives can help you identify the right opportunities, plan for success, and execute the right integration plan. Contact us for a pre-closing sales assessment or to get help optimizing your new organization and be one of the successful deals in 2019.

About the Author

Dan Rodenhaver is a senior business executive with focused experience in the healthcare industry, including developing and leading fast-track growth of medical devices and accelerating sales for companies ranging in size from startup to Fortune 500. Dan is an MBA expert in business development, product positioning, and market expansion with strong operating, financial, analytical and leadership capabilities.

Dan Rodenhaver is a senior business executive with focused experience in the healthcare industry, including developing and leading fast-track growth of medical devices and accelerating sales for companies ranging in size from startup to Fortune 500. Dan is an MBA expert in business development, product positioning, and market expansion with strong operating, financial, analytical and leadership capabilities.

Email Experts@FahrenheitAdvisors to get support for your sales team.