Executive Summaries That Drive Meetings

By Peter Buchanan, Managing Director

Frequently, the key ingredient that companies need to take many steps forward is funding from credible capital sources, such as Venture Capital funds and “seed investors” who have “been there, done that.” Outside capital makes companies “real” by providing the necessary fuel to drive product development, marketing, sales, and the other necessary functions. So – as an entrepreneur, how do you find this highly desirable outside capital? Well, you and your team need to a lot of work in four areas:

- You need to polish your verbal elevator pitch.

- You need to make progress every month in your company.

- You need to get warm introductions to the right funding sources from your friends and service providers.

- And you need to develop the documents that will enable professional and angel investors alike to evaluate your company objectively and make a positive investing decision.

Our purpose today is to talk about the Executive Summary – the document that you use to fire your first salvo into the investment community. The Executive Summary tells your story in anywhere from 1 to 5+ pages. Optimally, it is:

- Well-written.

- Comprehensive at a high level.

- Attention-getting.

- Passionate.

- Entertaining (given that it is a business document).

- A meeting driver.

Executive Summary: Length v. Content

Of all the investor documents, the Executive Summary provides you with the most freedom to create a winning story. It’s only 1 to 5 pages long, so why is it so flexible? Because it can be built in short, medium, or long form; you can vary the content and order of the information more than in other documents, and you can concentrate almost entirely on the story rather than the mechanics of how you are going to get things done. In short, it’s all about the power of the prose and pictures. Let’s talk about the forms of the summary:

The 1 Pager – boils down the Company’s story to the bare essentials:

- What the Company does and its customers (or target market if there are no customers yet).

- The opportunity (including the size of the market, if possible)

- A short summary of the products.

- Your business model – how you will get paid

- A pithy riff on management that concentrates on accomplishments.

- A financial snapshot.

Executive Summary – One Pager

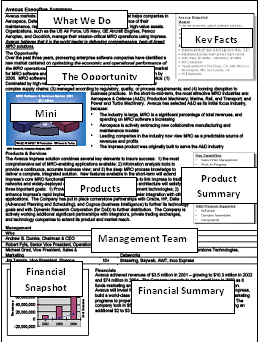

Frequently, 1-pagers are written in bullet form as “investment highlights”; however, bullets can be pretty boring. The best approach is to mix powerful, targeted text, one or two mini graphics that amplify the text, and tables and call out boxes that can deliver lots of information in a small space.

The 2 to 3 Pager – covers nearly all of the subjects that would be in a full-fledged business plan but at a high level. You need to say what you’re going to do, not how you are going to do it. And it should deliver information in an order that makes sense to an investor:

- Company Summary – ½ to ¾ page. This is your elevator pitch – only this time it’s in writing. It needs to say what you do and include the highlights that would be most interesting to an investor.

- Market Overview – ½ to ¾ page. You need to describe the market landscape, size and growth rate, and drivers.

- Products & Services – ½ to ¾ page. This explains what your products are, how they work, and their benefits to customers.

- Go-to-Market Strategy and Traction – ½ page. You explain your go-to-market approach, current traction, and any other key success factors related to acquiring and keeping customers.

- Competition – 1/3 to ½ page. This is where you position your Company and products against different types of customers and say why you win.

- Management – ½ to ¾ page. You shouldn’t skimp on tooting your own horn. This section typically has a paragraph or two that highlights the accomplishments of the most important team members followed by a table that summarizes their experience.

- Financials – 1/3 to ½ page. You should cover: (1) How you have been funded to date and how much money you want to bring in; (2) your key revenue drivers, and (3) key cost drivers. You should include a graphic that provides a picture and summary table of projected financial performance going out 4 to 5 years.

The 5+ Pager – is basically a mini-business plan. This form is less common than the first two forms. It covers all of the topics included in the 2 to 3 pager but in more depth. You should view the 5+-pager as an opportunity to go deeper into what your believe are your “difference makers.”

What type of summary should you write? The answer is: It depends. Generally, you can hand out a 1-pager to just about anyone. It doesn’t give away too much information and can create a good level of interest. The 2 to 3-pager is the most popular form, because it provides more information and context than a 1-pager but can still be read in under five minutes. The 5+-pager provides the most decision-making information and is generally shared with investors that are pre-briefed on the Company.

The DOs and DON’Ts of the Executive Summary

As you might expect, there are a bunch of DOs and DON’Ts to follow when you write your summary. In no particular order, here they are:

DO’s

Write one version, not custom versions for each investor.

- Part of attracting investment is learning to tell your story effectively – over and over and over again…. Think of it as being the pop star with the three-minute hit song that people want to hear once an hour all summer long. For the most part, investors have to like your story and embrace your vision, because they won’t be running your company – you will. It’s possible that your summary won’t inspire an ATM deposit and you’ll have to change it, but, generally, you do that after several meetings and 6 to 8 weeks, not one meeting and 6 to 8 hours.

Make sure your team understands and embraces the story.

- Usually, the CEO is best at spinning the tale; however, your team members meet people in their travels all the time. Everyone in your small, but promising, company needs to be able to tell some, consistent version of your story. Suppose there are three key things that you believe investors should know about your company. Let’s call them things A, B, and C. You might talk about those things in A, B, C order. Your CTO might discuss them as C, A, B, because C happens to be about the great, whiz-bang technology she has developed. The Sales VP might be with B, C, A, because B is really important to customers. The bottom line is, everyone needs to say approximately the same thing in his or her own way.

Get feedback before you swing for the fences.

- It’s definitely good when your entire team believes in your story, but there is such a thing as “drinking your own Kool-Aid.” You live most of your waking hours worrying about your business. Make sure you get a good set of reviews from trusted associates, friends, and advisors and incorporate the comments before your summary zips on its way to dozens or hundreds of people through the magic of the Internet.

DON’Ts

Avoid using lots of jargon.

- How many IT Infrastructure tools allegedly drive improvements from the data center core to end points on the network while reducing costs and increasing compliance? Yeah, way too many…. It’s hard to avoid technical terms and it’s sometimes advisable to use the buzzwords that Forrester and Gartner endorse, but remember that most investors aren’t technologists. They are financial and operating executives. They want to know three things: (1) How you’ll make money, (2) what about your offering is unique, and (3) how they’ll exit making goo-gobs of loot themselves.

Over-hyping kills deals.

- Make sure your summary is fact based. You should cite market size and growth rate numbers that come from credible, third party research houses. You should be very specific about the benefits that your product brings to customers and back up those benefits with provable statistics, if possible. Since most investors review hundreds of companies per year but invest in very few, it’s safe to assume that they have seen something like the hype your company represents before.

Leave the invisible ink at home.

- Your goal is to get investors to take a meeting and ultimately decide to fund your company. Investors need to be able in rapid succession to assess your market, link the product to the market, understand your sales strategy, evaluate the competition, examine your financial plan, and pass judgment on you and your team. Your summary needs to make this as easy as possible. Thumbs up, thumbs down. That’s what you want as quickly as possible. If you get past the summary and presentation stages, you’ll spend many, many hours with investors.

Some Final Words about Words

Finally, the number one factor in creating an Executive Summary that drives meetings is high quality writing. What is high quality writing? Well, it’s:

- Clear

- Concise

- Exciting

- Organized

- Targeted

Here are three, tremendous first sentences that most definitely don’t come from Executive Summaries:

“It was the best of times; it was the worst of times.”

– Charles Dickens, A Tale of Two Cities

“It was a dark and stormy night.”

– Edward Bulwer-Lytton, Paul Clifford

“The truth is, if old Major Dover hadn’t dropped dead at the Taunton races Jim never would have come to Thursgood’s at all.

– John Le Carre, Tinker, Tailor, Soldier, Spy

Dickens basically summarizes the plot of Tale of Two Cities in one sentence. In 1789, London was great – Paris, not so much. Buler-Lytton sets the mood for an excellent 19th century novel. (Plus, he unknowingly gave Snoopy something to plagiarize.) Le Carre causes you to ask so many questions: Who are Major Dover and Jim? What’s Thursgood’s? Why did Major Dover die anyway?

You need the business equivalent of a Dickensian first sentence, and you need to carry it through to your first paragraph, first page, and entire document. Here is the type of first sentence that has driven a lot of meetings (the names have been changed to protect the innocent):

Company A is building the world’s most capable mobile advertising network to enable unmatched reach, frequency, and targeting for marketers at the lowest possible delivery cost. Through the Company A network, marketers can transform the mobile phone into a personal medium for delivering valuable, actionable offers to consumers.

In the first two sentences, the product and value-proposition for both marketers and consumers is perfectly clear.

Here are the ways that you can ensure that your writing is high quality:

- Once you have written the first draft, go through it word-by-word and eliminate any word that isn’t really necessary to the story. You’ll be amazed at how clear your writing becomes.

- Pay attention to those little, green, “bad grammar” lines in Microsoft Word. They either mean that there is a better way to say something, or you may have actually written a sentence that is grammatically challenged in some fundamental way.

- Have good writers critique and edit your work, and don’t be afraid to do major rework as a result.

- Finally, if you’re a really bad writer, get someone else to write the summary. Investors are betting on you as a leader, not you as a writer.

Peter Buchanan

Peter Buchanan has worked both as an executive-level advisor focusing on strategy, business development, and marketing, and in operating roles as a CEO, strategic planner, product manager, and sales manager. As a consultant, he co-founded three, successful professional services companies, where he developed strategies, business models, fundable business plans, and successful market messages that have been implemented by hundreds of start-up, growth, and mid-market companies. As CEO, Peter has led companies through periods of rapid growth and scaling. Peter has worked with companies to create over 200 strategic and business plans for growth and middle market companies seeking a funding, M&A, or spinout transaction. Over 70 percent of these engagements generated a successful transaction. In total, his clients have raised over $600 million in early and mid-stage funding and several achieved successful exits through high-value M&A transactions. Peter also served as a fractional head of strategy and corporate development for multiple high growth companies.

Contact Info d: 703-574-4668 | c: 301-367-1657 | pbuchanan@fahrenheitadvisors.com