-

Fahrenheit Congratulates Melina Davis-Martin on Being Selected as EVP at the Medical Society of Virginia

Melina Davis-Martin has been named executive vice president of the Medical Society of Virginia, a statewide organization representing the interests of physicians. She assumes her job as the organization’s chief employed officer Tuesday, December 16, 2014. Melina is a seasoned business and association executive and brings public and non-profit sector leadership experience to this role. She is a successful entrepreneur,…Read More -

Are you (and your team) Ready to Tackle 2015?

I came across this great article from my good friend Nancy Eberhardt and thought I would take a moment to share it. In her article, Nancy poses a question...and it happens to also be in the title of her article...(when planning for your business) what is the single most important question for 2015? At Fahrenheit, our team of advisors and…Read More -

Fahrenheit’s Keith Middleton joins March of Dimes to Honor Perdue’s Tradition of giving

PRESS RELEASE: MARCH OF DIMES HONORS PERDUE ASSOCIATES FOR DECADES OF SUPPORT AND LEADERSHIP IN VIRGINIA Date: November 12, 2014 Contact: Susan Smith, Div. Executive Director, 757-383-8817 or swsmith@marchofdimes.com, Bill See, Communications Manager – Perdue, 410-341-2412 or Bill.See@perdue.com ACCOMAC, VA. (Wednesday, Nov. 12, 2014) — For 36 years, associates at Perdue Farms’ operation in Accomac, Va., and their families have…Read More -

Talkin’ ‘Bout my Valuation – AND – Smart Investors

By Peter Buchanan, Managing Director Let’s say that, as the CEO, you believe your company is worth a $100 million, pre-money valuation. This number fits in your long term financial plan for yourself and your team, and you believe that investors should be thrilled to invest $10 million to participate at this valuation. Well, the truth is, despite your strongly…Read More -

Benefits Available from R&D Tax Extension

Some good news did actually come out of the 2014 Virginia legislative session. The benefits available from the VA Research and Development Tax Credit have been expanded and extended to 2018. For 2014, 15% or 20% of qualifying R&D expenses (the higher amount applies if the research was conducted in connection with a VA college or university) can be refunded…Read More -

Fahrenheit Experience Day at Lighthouse Lab’s

The Fahrenheit Group presented the Fahrenheit Experience Day to the Lighthouse Lab participants in late October hosted at the VCU School of Business. Fourteen members of Fahrenheit’s Advisory, Finance and Human Resource teams are involved with Lighthouse Labs, providing guidance and mentoring. The full day consisted of presentations by the six Lighthouse Lab teams and six breakout sessions led by…Read More -

Will Higher Thresholds on Angel Investing Hurt Business?

With the rich getting richer, many more entrepreneurs are turning to affluent individuals, known as “angels,” for capital to expand their nascent businesses. Angels put $24.8 billion of their own money into 70,730 U.S. businesses in 2013, for instance, 41% more than the $17.6 billion they put into 57,225 businesses in 2009. Meanwhile, Americans’ wealth hit new records during the…Read More -

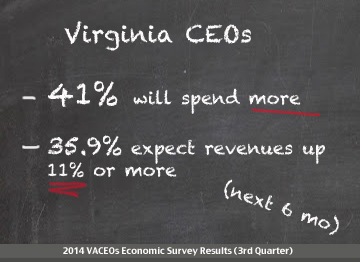

Survey Says…Economic Outlook is UP

Robins School of Business – Virginia Council of CEOs survey shows highest level of optimism in four years.

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region.

The survey results provided by Richard Coughlan, Senior Associate Dean at the Robins School of Business,…Read More

Robins School of Business – Virginia Council of CEOs survey shows highest level of optimism in four years.

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region.

The survey results provided by Richard Coughlan, Senior Associate Dean at the Robins School of Business,…Read More -

Congrats to our Friends at Team Henry for Being Named to Fortune List – the 100 Fastest-growing Inner-city Businesses in the Country

Three Virginia companies have been named to a list of the 100 fastest-growing inner-city businesses in the country. Team Henry Enterprises in Newport News ranked No. 12, River City Comprehensive Counseling Services in Richmond was No. 13 and The Pediatric Connection in Richmond was No. 97 on the 2014 Inner City 100 compiled by Initiative for a Competitive Inner City…Read More -

Fahrenheit Goes West with Axeo Merger

Danika Worthington Editorial intern / Email Phoenix Business Journal Richmond-based Fahrenheit Group announced a merger with Virginia-based Axeo this month allowing the advisory group to now provide HR resources under the new name FahrenheitHR West. Fahrenheit Group, founded in 2010, provides advisory, accounting and finance services. Axeo, an HR consulting firm, has roots in the greater Washington, D.C. area. Axeo…Read More -

The Seven Deadly Sins of Entrepreneurs (And How to Fix Them)

The Seven Deadly Sins of Entrepreneurs (And How to Fix Them) By Peter S Buchanan, Managing Partner Fahrenheit Advisors It’s an age-old and true maxim that great entrepreneurs usually don’t make it to the executive suite at IBM, GE, HP, or Exxon. Big companies love the upside – the passion, the long hours, the breakthrough thinking, the ability to inspire…Read More -

Startup Weekend Fredericksburg Had It Covered

From Trade Shows to Christmas Lights to Earthworms: Startup Weekend Fredericksburg Had It Covered

Recently, Germanna Community College hosted Fredericksburg’s third Startup Weekend in 18 months. In 54 hours, eight teams came together and developed, researched and launched companies that brought in sales before the judging on Sunday evening. Scott Ukrop represented Fahrenheit as a judge along with DJ Bruggemann,…Read More

From Trade Shows to Christmas Lights to Earthworms: Startup Weekend Fredericksburg Had It Covered

Recently, Germanna Community College hosted Fredericksburg’s third Startup Weekend in 18 months. In 54 hours, eight teams came together and developed, researched and launched companies that brought in sales before the judging on Sunday evening. Scott Ukrop represented Fahrenheit as a judge along with DJ Bruggemann,…Read More